In today’s highly competitive financial landscape, financial institutions must balance speed, accuracy, and compliance when reviewing loan applications. The loan approval process is crucial, yet often complex and time-consuming. Traditional methods rely heavily on manual efforts, including extracting data from unstructured documents, applying complex compliance rules, and integrating various data sources to make informed decisions. These methods lead to inefficiencies, errors, and delays in decision-making, often at the expense of customer satisfaction and regulatory compliance.

At Rudder Analytics, we developed an AI-powered solution designed to address these challenges head-on. Our client, a leading financial institution, was facing increasing pressure to process loan applications more efficiently while ensuring full regulatory compliance. The traditional process was not only slow but also prone to inconsistencies, with important external context frequently being overlooked during the decision-making process. We set out to design a system that could automate critical steps, integrate external contextual data, and ensure human oversight throughout, all while maintaining compliance and enhancing operational efficiency.

Challenges in Traditional Loan Approval Systems

Complex and Unstructured Compliance Rules

Compliance rules are often found in lengthy, unstructured PDFs, making them difficult and time-consuming to interpret manually. This complexity can result in human errors, inconsistent assessments, and regulatory risks, especially when ensuring the consistent application of rules across multiple applications.

Diverse User Data

Applicants submit data in various formats—income statements, tax returns, forms—that are unstructured and difficult to analyze manually. Extracting relevant insights and structuring them into a consistent profile can be time-consuming, slowing down the approval process.

Contextual Blind Spots

Relying solely on applicant-submitted data often misses critical external risk factors, such as undisclosed financial activities or legal issues, which can significantly impact an applicant’s eligibility. Without access to these external data points, the loan approval process can be incomplete and risky.

Information Silos

Traditional systems create information silos, with loan reviewers manually linking internal applicant data, external compliance data, and risk factors. This inefficient process leaves room for missed information and errors, making it difficult to conduct a comprehensive evaluation of the loan application.

Auditability and Consistency

Manual methods struggle to provide a clear, auditable decision trail, leading to inconsistent decision-making. This lack of consistency can pose challenges in maintaining regulatory compliance and conducting audits, potentially resulting in legal and operational risks.

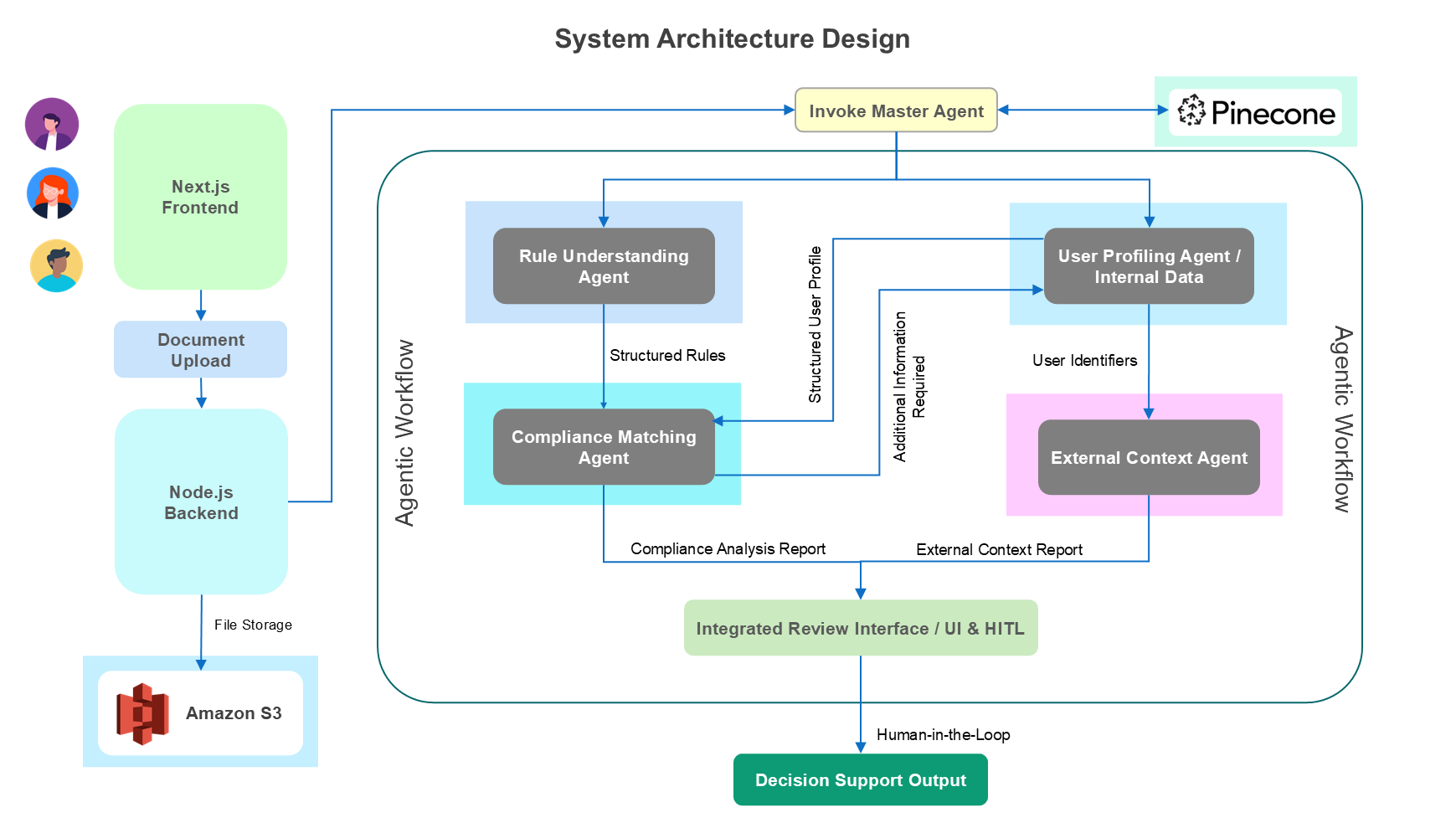

Solution Overview: A High-Level Walkthrough

Smart Data Collection

The agent automatically collects and processes:

Applicant documents (pay stubs, tax returns)

Credit reports (from Experian, Equifax, etc.)

Property information (appraisals, valuations)

Historical transaction data

Modern tools like Azure Form Recognizer and OCR engines extract structured data from any format, reducing manual input and errors.

Risk Assessment

The agent uses advanced models (such as Graph Neural Networks) to:

Predict the likelihood of default or fraud.

Flag unusual or risky patterns (e.g., sudden income changes, suspicious asset transfers)

Adjust risk scores dynamically as new data arrives.

Automated Decision-Making with Human Oversight

The system can automatically approve, reject, or flag applications for manual review. It’s not a black box: every decision is explained, with clear reasoning and references to underlying data, crucial for compliance and customer trust.

Continuous Learning and Compliance

The AI agent learns from outcomes, adapting to new trends (like economic shifts or emerging fraud tactics). It also maintains a full audit trail, supporting regulatory requirements and internal audits.

Why LangGraph?

LangGraph is a next-generation framework that combines the power of language models (like GPT) with graph-based reasoning. This means the AI agent doesn’t just look at isolated data points- it understands relationships and context, much like a human underwriter would, but at machine speed.

Key Phases of the AI-Powered Loan Approval System

The system we developed integrates several phases, each powered by cutting-edge technology and designed to address our client’s specific challenges in loan underwriting.

Phase 1: Rule Understanding Agent

The first phase of the system focuses on automating the extraction and interpretation of compliance rules from unstructured vendor PDFs.

We used OCR (Optical Character Recognition) and Large Language Models (LLMs) to convert text from these PDFs into machine-readable data. LLMs helped understand the context of the rules, allowing the system to structure them into a usable format (e.g., JSON).

By doing so, we eliminated the manual effort involved in rule extraction, making the process faster and more consistent.

During compliance checks, these structured rules were stored in a database for easy querying and comparison.

Phase 2: User Profiling Agent

Next, we automated the creation of a structured user profile from the diverse data submitted by applicants.

Our system processes data from financial records, tax returns, and forms using Natural Language Processing (NLP) algorithms to identify key metrics such as income, assets, and liabilities.

Using Document AI, the extracted data was standardized and organized into a structured format.

This profiling process ensures that all applicants are assessed based on consistent criteria, reducing errors and ensuring that no critical financial data is overlooked.

Phase 3: External Context Gathering

To ensure a comprehensive assessment, the system also gathers external contextual data.

Using tools like Scrapy for web scraping and Playwright for handling dynamic websites, we collected publicly available data such as regulatory watchlists, news articles, and financial records.

APIs were used to integrate external databases, such as Experian and Equifax, along with government and financial institution records.

This external context was analyzed using LLMs, which classified and flagged any potential risks related to the applicant’s background.

By integrating this data, we helped the client gain a more complete understanding of each applicant’s risk profile.

Phase 4: Compliance Matching Agent

Once the applicant’s data and the compliance rules were structured, the system matched the data against the compliance rules to ensure adherence to regulations.

A dedicated LLM-based agent was introduced to evaluate compliance by processing structured rules and application data.

All compliance rules and criteria are passed to the LLM, which performs the validation and identifies any mismatches.

This agent functions independently within the system architecture, fetching applicant profiles and relevant documents from the agent server.

Phase 5: Integrated Review Interface (HITL UI)

The final phase of the system involves presenting a unified report that integrates the compliance findings, external context, and the applicant’s profile.

This report is displayed through a Human-in-the-Loop (HITL) interface, which provides underwriters with an intuitive platform to review all relevant information in one place.

The reviewer can assess the findings, make any necessary adjustments, and approve or reject the loan application based on a comprehensive and fully informed decision.

Impact for Our Client

The implementation of this AI-powered loan approval system has brought significant improvements to our client’s loan processing capabilities. Here are some of the key impacts:

60% Reduction in Loan Processing Time: By automating key steps, our client has been able to process loans faster, reducing the overall approval time by over 60%.

80% Reduction in Compliance Errors: The automated compliance checks have drastically reduced human errors in rule interpretation, ensuring that applications are consistently assessed against the correct criteria.

50% Increase in Operational Efficiency: With less manual work involved, our client has seen a 50% increase in underwriting team efficiency, allowing them to handle more applications with fewer resources.

30% Improvement in Risk Assessment Accuracy: By integrating external context data, our client now has a more complete view of each applicant’s risk profile, leading to a 30% improvement in the accuracy of their risk assessments.

25% Increase in Reviewer Productivity: The unified review interface has made it easier for underwriters to assess applications, boosting productivity by 25%.

Critical Considerations

Our client is committed to maintaining legal, ethical, and privacy standards throughout the loan approval process. Key considerations include:

Data Handling and Privacy: The AI system adheres to data protection regulations like GDPR, ensuring that all sensitive applicant data is securely stored and processed.

Bias Mitigation: The system flags uncertain or potentially biased external data and allows for human review, helping to ensure fair decision-making.

Human Oversight: The Human-in-the-Loop (HITL) interface provides an additional layer of validation to ensure that all decisions are accurate and fair.

Elevate your projects with our expertise in cutting-edge technology and innovation. Whether it’s advancing data capabilities or pioneering in new tech frontiers such as AI, our team is ready to collaborate and drive success. Join us in shaping the future—explore our services, and let’s create something remarkable together. Connect with us today and take the first step towards transforming your ideas into reality.

Drop by and say hello! Medium LinkedIn Facebook Instagram X GitHub